Thursday, February 25, 2010

Market Action

Technical & On Broker’s Notes

AgriNurture (PSE:ANI) – gap filled at 18.50, and have formed a neutral stand on its on consolidating pattern. With base low at 15.75, ANI needs to tackle 19 (15.75 x 1.20 = 18.90) for reversal.

Metro Pacific Investments (PSE:MPI) - heavy support again by CLSA. Big seller JP Morgan is still dumping together with Deutsche.Any cross sales done by these two sellers is favorable to MPI.

IPVG (PSE:IP) – earlier at 1.82, IP registered an RSI readings of 50.60 (considered oversold if RSI is at 50-52but not <>

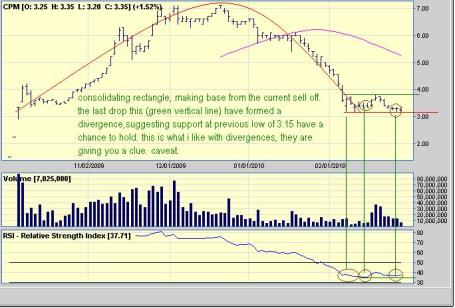

Century Peak Metals (PSE:CPM) – Nice base building.

Labels: century peak metals, cpm. pse cpm, mining company, philippine stock market

Friday, January 29, 2010

Market Action

Note: Updated within the day)

9:44am PAX opened at 2.50, gapping 4 cents from its yesterday’s close at 2.46

9:48am After opening at 68, the stock lost its grip as investors find it to pricey to push IMI to its 5th consecutive limit up of 50% gain for the day. Currently trading to 40 a piece, down 5.50 from yesterday.

10:00am Broker 209 started doing cross sales at SMDC, totalling to 1M shares at 2.50 (4 blocks of 250k shares).

10:30am APC (+0.03, +9.68%) in the attached disclosure dated January 26, 2010, stated among others that: We would like to report that the Board of Directors of APC Group, Inc. (“Company”) in a meeting held today, January 26, 2010, approved the quasi-reorganization of the Company by way of reducing the Company’s par value per share. The reduction in par value will initially result in the reduction of the Company’s negative retained earnings (deficit) approximately by half. The new par value of the Company’s shares and the exact amount of the resulting reduction in deficit will be decided after further study and consideration.

10:40am The Philippine Stock Echange Index (PSEi) have been undecided all day, keeping a narrow range at the 2,900 level.Previous support at 2,950 is now a resistance. Heavy weight Ayala Corp (PSE:AC, +2.50, +0.86%) is adding support to the market.

11:00am SMDC alert. Total 3m shares crossed by broker 209.

11:06amTechnical watch. MRC (+0.01, +1.41%) is within a triangle make or break.resistance at 0.79 & 0.88 (current high) and support pegs at 0.66 & 0.59

11:26am Still Consolidating. Pepsi Philippines (PSE:PIP) remains unchanged at 2.30/share. Buyer is still ATR. I noticed they’re been on defensive buying mode. The stock have shown to be resilient and stayed on the 2.30 level despite the index selldown previously. A break at 2.55 will open gates at 3.50, Pepsi’s IPO price.

11:50am PSEi (+38 pts, +1.31%) going pass the 2,950 initial resistance. The divergence as previously pointed out yesterday proved to be a signal that the index have enough of this emotional tantrums. Psychological resistance points to the 3,000 level. Expect confidence to build up as 2,950 was taken.

11:58amConfirmed. The Famous Father of All Funds, Mark Mobius of Templeton Asset was in Cebu last week. Business or Pleasure? I’m not guessing.

Labels: mrc, pepsi, philippine stock market, phisix, pip, psei

Wednesday, June 03, 2009

Aud/NZ - SP500 Vbottom Comparison

Gold Wedge Theory Points to June 12 as short term top

Thursday, May 21, 2009

Euro/Usd & Gbp/Usd Daily Chart with Position

Cable Position

Labels: british pound, cable, euro usd daily chart, euro/gbp, euro/usd, gbp usd daily chart, gbp/usd

Friday, May 08, 2009

Thursday, May 07, 2009

S&P 500 in for a MAJOR CORRECTION soon

Labels: sp 500, stock market

Wednesday, May 06, 2009

What is long term in the equity markets?

http://www.linkedin.com/answers/financial-markets/equity-markets/MKT_EQU/471208-37949623

What is long term in the equity markets?

“Long term investment” is one of the very often used and very less understood term. Whenever someone speaks of long term, be it an investor or a fund manager, the only thing that comes to my mind is he has lost money as I feel ‘Long term is only when you are wrong in the short term’.

What is long term in your view.

My answer is no offense meant…longterm for me is like “etc”. Its a hard fact for every investors that the real meaning of long term is ‘Long term is only when you are wrong in the short term’. I’m a small investor thus maybe my thinking is not the same as the one who goes long term. But im in this business half my life so i have known and experienced my clients pain and gain. Long term is a no cut loss investment and involve justifying your mistake once your stock plummet by saying “im not worried, im in for the long haul”. How can we be sure that in 5 years time, our term investment can rake profits. We are no Warren Buffet whose pockets are way to deep to fathom. For most of us, we’re a one stock - buy investors. Meaning we buy one time and that’s it. Markets are dynamic and so complex nowadays. What is appealing in the 1930’s is not the same as today. Honestly, when i hold a seminar and somebody ask what is the best stock for the long term, i tell them humbly, “you pick one and i’ll say yes”. An analyst cannot go wrong in his calls, advising his clients what to buy for the long haul. and modesty aside, it’s the simplest question which even my 7-year old daughter can answer. NO offense meant.

Labels: equities, long term investment, stock market, what i slong term investment

On Broker's Analysis - MEGAWORLD (PSE: MEG)

Meg's top buyers

Time & Sales

Cross sales

This is one of the reason why most of my clients who have megaworld shares sold today. early trading we saw a barrage of buying done by foreign brokers. From the way they aggressively bought up the shares, program buying is their theme for today. Filipino traders have a festival on Meg’s occasion today. Unfortunately, this festivity where local traders are making a profit on foreign brokers’ buying and selling are about to end. The Philippine Stock Exchange are about to adapt a rule hiding a broker’s identity in buying and selling. Once implemented, local traders and investors can no longer “monitor” who’s buying and selling. This rule for me is anti-investor and protects only the big foreign houses. There will be massive front running and investors have no protection whatsoever, specially if they “put an open price order” to their brokers’ discretion. Anyway, that’s another story.

Back to Meg. Program buying have huge impact on the intraday activities of a stock price. A magnitude such as this will definitely buoy up the stock. Same is true to program selling. In timing the “ride”, I look for huge crosses to signal that the “program” is nearing completion or have rested. This is the same example i posted on PEPSI’s broker’s analysis and the relevance of crosses. In Meg, CLSA’s activity is definitely program buying. From near mid 0.70s on the way up to 0.80s. After which, made huge crosses at 0.82 and 0.84. For me that’s the signal that the program was done for the day, thus we sell. If it continues on the next day, buying back even at a price higher than our selling price is not a problem with us. We don’t buy price, we buy momentum and patterns and reasons. Same goes as why we sell.

Labels: broker's analysis, cross sale, megaworld, philippine stock market, pse, pse meg, stock market

Tuesday, May 05, 2009

American Idol - Adam Lambert is..... she?

My whole family is a HUGE fan of Adam as well. I mean that guy can sing to the top of his voice. We were shocked that he landed on the bottom 3 last week. Maybe the photos being exposed on the net is one factor why Adam landed on the bottom 3. Still, Adam, gay or not, man you rock. My daughter lost her interest in your pretty face though. Can't blame her. Oh well, Rock on man, Rock On!!!!

photo credits by buddytv.com

Labels: adam lambert, adam lambert is gay, adam lambert scandal, american idol

Sunday, May 03, 2009

pacquiao k.o. hatton in 5th round

Labels: hitman, manny pacquiao, pacman, pacquiao vs hatton, pacquiao wins

Thursday, April 30, 2009

Free Online Game

Labels: free online game

Tuesday, April 28, 2009

Aud/Usd Daily Chart

Pepsi Philippines (PSE: PIP) & Benpres Holdings (PSE: BPC)

Monday, April 27, 2009

Daily Bread

----------------------------------------

April 27, 2009

First Things First

READ: Matthew 6:25-34

Seek first the kingdom of God and His righteousness. —Matthew 6:33

A seminar leader wanted to make an important point, so he took a wide-mouth jar and filled it with rocks. “Is the jar full?” he asked. “Yes,” came a reply. “Oh, really?” he said. Then he poured smaller pebbles into the jar to fill the spaces between the rocks. “Is it full now?” “Yes,” said someone else. “Oh, really?” He then filled the remaining spaces between the rocks and stones with sand. “Is it full now?” he asked. “Probably not,” said another, to the amusement of the audience. Then he took a pitcher of water and poured it into the jar.

“What’s the lesson we learn from this?” he asked. An eager participant spoke up, “No matter how full the jar is, there’s always room for more.” “Not quite,” said the leader. “The lesson is: to get everything in the jar, you must always put the big things in first.”

Jesus proclaimed a similar principle in the Sermon on the Mount. He knew that we waste our time worrying about the little things that seem so urgent but crowd out the big things of eternal value. “Your heavenly Father knows that you need all these things,” Jesus reminded His hearers. “But seek first the kingdom of God and His righteousness, and all these things shall be added to you” (Matt. 6:32-33).

What are you putting first in your life? — Dennis J. De Haan

Make It Practical

• Always pray before planning.

• Always love people more than things.

• Do all things to please God.

Those who lay up treasures in heaven are the richest people on earth.

Labels: daily bread, God, Jesus

All in for GOLD

today's gold activity is of little change, which i is one of the ingredients i wanted to see. i am now convinced that gold wil lmake a run of $40-$60 in 1 day or 2 within this week. I'm all in for gold. caveat.

Labels: gold, technical analysis gold

Saturday, April 25, 2009

Southeast Asia Cement Hldgs, Inc. (PSE: CMT)

The $1 Technical Analysis

sp500 target of 950 this may09 is still on.a free sample technical analysis at my personal blog. i believe the may 4 stress test is a non event. i think major short covering will happen as the news discount itself, leading to a spike at the 950 neck. after which, being a short term nature of the spike, profit taking will set in as investors will realized the sp500 have gone up too fast too soon.

picture perfect: driving force of the sp spike to 950 is the n0n event may 4 scenario. weekly job loss chart is in parabolic spike as well. if the paras is in wave 5 now, it will top this may09 or weaken a bit. the last study i have was in january when i mistook wave 3 as 5 with a target of may09 as the para burst. as most analyst were searching for the next bubble, i have search mine in a form of us weekly job loss.

back to sp. a wonderful inverted hs may take place after the said 950 sp spike. testing the 50ma on the daily chart, possible 800 low to mid. time element will be 3 months or so in forming right shoulder. a break at the 950 neck will mean 1k target in late quarter and possible yr end target of 1100 or near. caveat.

please see chart of s&p 500 on my previous post.

I am offering my services to any foreign investors, institution, brokerage houses, banks and many others. For a minimal “hard earned living” fee of $1 only, any charts, any markets, you send i’ll gladly make a technical analysis. paypal payment. there’s no harm in trying me out.

Labels: charting, commodities analysis, forex, fx, gold, sp 500, stock market, technical analysis

Friday, April 24, 2009

S&P 500 Weekly Chart

First Philippine Holdings (PSE: FPH)

Labels: first philippine holdings, fph, lopez company, lopez stocks, philippine stock market, pse fph, triangle pattern

Spot Gold hourly chart

Gold Daily Chart April 24, 2009

Thursday, April 23, 2009

Broker's Analysis: Pepsi Philippines (PSE: PIP)

clean breakout. now running at 1.12 (actual time). made a high of 1.16.

Our house has been a buyer since the mid 0.60's since my wordpress blog (http://spyfrat.wordpress.com/) was first published last Oct of 2008.

UBS still selling but with crosses from time to time. UBS is the one who's been dumping this stock till mid 0.60's last year.

Here's the latest broker's activity.

Labels: broker's analysis, cross sale, kings securities, pepsi, pepsi phil, pip, summit securities, ubs securities

Subscribe to Posts [Atom]